September 30, 2023

Consumers must stay alert to the latest attempts by scammers to access personal financial data. Scammers are using all sorts of tricks to get you to believe you are communicating with an actual credit union employee.

Financial Institution impersonation scams are on the rise with the most common scams happening over emails, text messages and phone calls.

Scammers Impersonating Financial Institutions

Phone Calls

Scammers may also pose as Financial Institution employees claiming they need to discuss an important matter related to your account. They will ask you to answer a few questions to verify your identity.

As you are relaying the information, the scammers might be accessing your account online with the information you provide. This may trigger a multi-factor authentication code or PIN sent to your phone, which the scammer will ask you to give them. Some scammers can spoof phone numbers to make them appear like a local number or display the Financial Institution’s name.

Email or Text Scams

You might receive an email or text message that appears to come from your Financial Institution. Most commonly, they’ll claim you have a suspicious charge to your debit card or checking account and need some information to restore your account or confirm your identity. They will ask you to provide your personal information, account or card numbers, PINs, or passwords to gain access, take over your account, and steal your money.

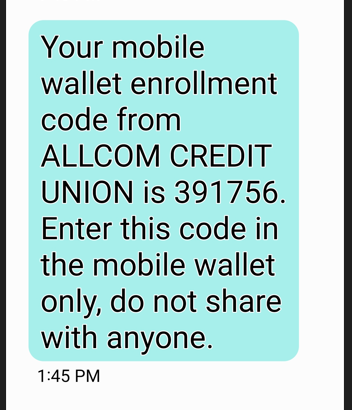

Members may receive text messages from AllCom for fraud alerts on debit/credit cards. These messages should NEVER be shared with anyone else. AllCom will NEVER ask for the information from these messages.

Additional Types of Fraud & Scams

Social Media Scams

Scammers create fake social media posts and profiles to convince you to share your personal or financial information. Instead of creating a fake profile, scammers may also take over an existing one. Scammers use the hacked profile to contact the person’s friends and family and ask for money or to promote a link to a fraudulent site they own.

Grandparent Scams

If you get a call from someone who sounds like a grandchild or relative asking you to wire or transfer money or send gift cards to help them out of trouble, it could be a scam.

Debt Collection Scams

Most debt collectors will contact you to collect on legitimate debts you owe. But there are scammers who pose as debt collectors to get you to pay for debts you don’t owe or ones you’ve already paid.

Money Transfer or Mobile Payment Services Fraud

Con artists use money transfers to steal people’s money. If someone you don’t know asks you to send money to them, it should be a red flag. Scammers also use mobile payment services to trick people into sending money or merchandise without holding up their end of the deal.

How to Protect Yourself from Scams

- Never share personal information or a one time code you receive via SMS text message. Legitimate attempts to validate credit or debit card activity only requires a simple response (YES or NO) via text.

- Do not click on hyperlinked phone numbers sent via SMS text or on links inside emails.

- Pause before providing personal data via phone calls you did not initiate, even if the caller ID is reading a known financial institution or business. Hang up and contact the financial institution or business directly.

- Don’t agree to receive or send money or packages for people you either don’t know or haven’t met, especially if they are requesting money by gift card, wire transfer, bitcoin or mobile wallet.

- Be on the lookout for suspicious social media posts, including limited-time offers or discounts that seem too good to be true, and requests for personal or account information.

AllCom will never ask you for personal information, passwords, verification codes or to transfer money. Call 508.754.9980 with questions or to report a scam. Click below for more information on the most common types of fraud and scams.

February 25, 2023

Mail Theft Uptick Leads to Check Fraud

According to the U.S. Postal Service Office of Inspector General, mail theft complaints more than doubled from March 2020 to February 2021. The criminals rob mailboxes and mail carriers of the master keys to the blue mailbox drops to gain access to the mail. The criminals then sift through to locate checks that can be altered, counterfeited, or sold online.

In several cases, member-issued checks have been stolen from USPS mailboxes, as well as members’ mailboxes, altered, and negotiated elsewhere. The checks can also be used to open fraudulent new accounts and loans using the name and address information for stolen identities.

Mail theft and armed robberies against U.S. Postal Service carriers have increased substantially throughout the country. The criminal’s focus is to gain access to the master keys of the blue USPS mailboxes –ultimately in search for checks that can be altered, counterfeited, or sold online.

AllCom Credit Union members are encouraged to sign up for direct deposit, pay bills online or use AllCom’s bill pay service via online and mobile banking. If you need to mail a check, consider mailing them inside the Post Office lobby rather than using blue mailboxes. As always, we encourage our members to log into your accounts frequently to review transaction history – looking for unfamiliar transactions. Please report unfamiliar and unauthorized transactions immediately to AllCom.

January 26, 2023

Chick-fil-A Investigates Suspicious Activity on its Chick-fil-A One App

In a statement released by Chick-fil-A on Jan. 4, 2023, the company announced that suspicious activity has occurred on some Chick-fil-A One accounts. AllCom continues to monitor the situation. Chick-fil-A One account holders are advised to change their password and remove all payment information on the app immediately. For more information, please visit Chick-fil-A’s customer support website here.

December 27, 2022

Learn the Signs of a Fake Survey

Lately, AllCom has been seeing members fall for surveys by inputting card information on fake “survey sites”.

Some key tips to remember:

- If it sounds too good to be true, it probably is. We are up-to-date on all the latest scams – you can always call and ask for our opinion.

- Free trials, free samples, surveys, social media offers and pay for shipping only transactions should always raise concern and be researched further. A quick Google search or call to the credit union can help determine if something is legitimate. There have been many members who participate in these types of transactions and later they find out they have been enrolled in a subscription they weren’t aware of (because they didn’t read fine print).

- Even if an email, text, phone call, source, etc. says they’re a particular merchant doesn’t necessarily mean they are. Example: You get an email from Kohl’s asking you to fill out a survey and in return, you’ll receive a free item if you just pay for shipping. You give them your card number to pay for shipping and then nothing is ever delivered. Sometimes these scammers may even start charging other unauthorized amounts.

Always keep in mind:

- Once again, if it sounds too good to be true it probably is

- Free trials always have fine print and typically enroll you into a subscription unless you cancel before you’re charged

- If your card info is needed for something and you’re told you won’t be charged, it should raise suspicion

- If you’re promised goods or money in return for doing something, it should raise suspicion

- Scammers are great at what they do. There are countless ways they can find out information and contact people. It’s important to learn all their tricks and be able to identify scams

- When in doubt, Google is a great tool. Most of the scam situations can be Googled with results showing people who have already complained online

- AllCom team members are available (888.754.9980) to help determine if it’s a scam

For more information on fake surveys visit: https://www.bbb.org/all/spot-a-scam/signs-of-a-fake-survey.