If you’re looking for a financial institution that feels more like a neighbor than a number, look no further than AllCom Credit Union. Located on Park Ave. in Worcester, AllCom is where members are known by name, not account number. You’ll always reach a real person when you call, not a recording.

With over 4,000 members and $80 million in assets, AllCom is one of the city’s best-kept secrets. Founded in 1922 to serve employees of the New England Telephone Company, we’ve proudly called Worcester home for more than 100 years. Since 1988, our branch on Park Ave – right across from Starbucks and New England Roast Beef – has been a neighborhood landmark.

But we’re more than just a building on Park Avenue – we’re part of the community. Over the years, we’ve proudly supported and participated in local events, school programs, and charitable initiatives. Whether it’s sponsoring local fundraisers or volunteering at community events, AllCom is woven into the fabric of Worcester life.

Thanks to investments in technology, our members enjoy the same conveniences as they would at a larger bank – from a convenient mobile app to a paperless loan application process – all backed by a team that truly cares.

“Credit Unions are owned by their members and at AllCom, our members come first,” says Laura Ybarra, President & CEO of AllCom since 2022. A Worcester native, Laura’s story is deeply tied to the Credit Union. She joined through a Worcester Public Schools school-to-work program at Doherty High School and has been with AllCom for over 27 years. Her journey from student intern to President/CEO reflects the values we hold dear: loyalty, community, and personal growth.

AllCom serves a broad local membership – from local telephone, gas, utility and postal service employees to individuals and families throughout Worcester County and parts of Middlesex County. If you live, work, or go to school in the area, you’re eligible to join our Credit Union family.

We may be smaller in size, but we think that’s part of our charm. With just one branch and a committed team, we offer a level of personalized service that’s not commonly found. “We carry the same products and offer the same services as larger Banks and Credit Unions,” says Ybarra. That includes standout offerings like The Rate Improver Mortgage, a 30-year fixed mortgage that allows members to lower their rate within 5 years as market rates drop, without refinancing fees.

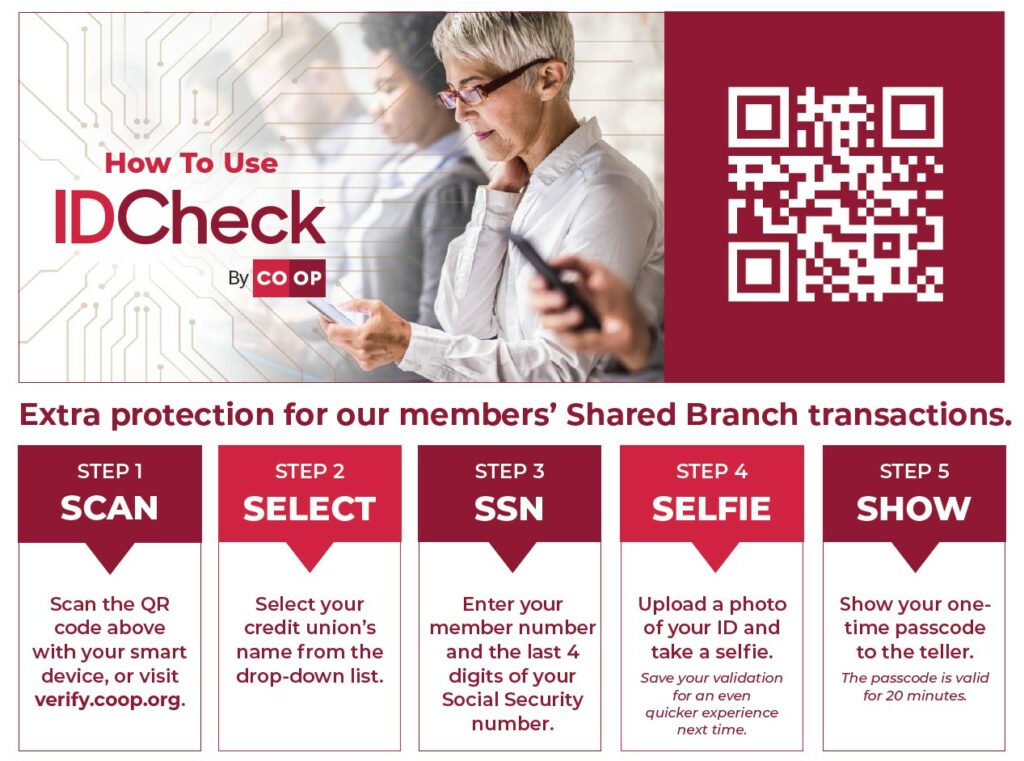

And while we’re proud to be your local Credit Union, we’re here for you wherever life takes you. Through our partnership with the CO-OP Shared Branch Network, members can access account services at more than 5,600 Credit Unions nationwide. So whether you’re away at college, traveling out of state, or relocating, AllCom goes with you.

At AllCom Credit Union, we’re not just in your neighborhood – we’re part of it. Banking Made Better. Learn more at allcomcu.org.